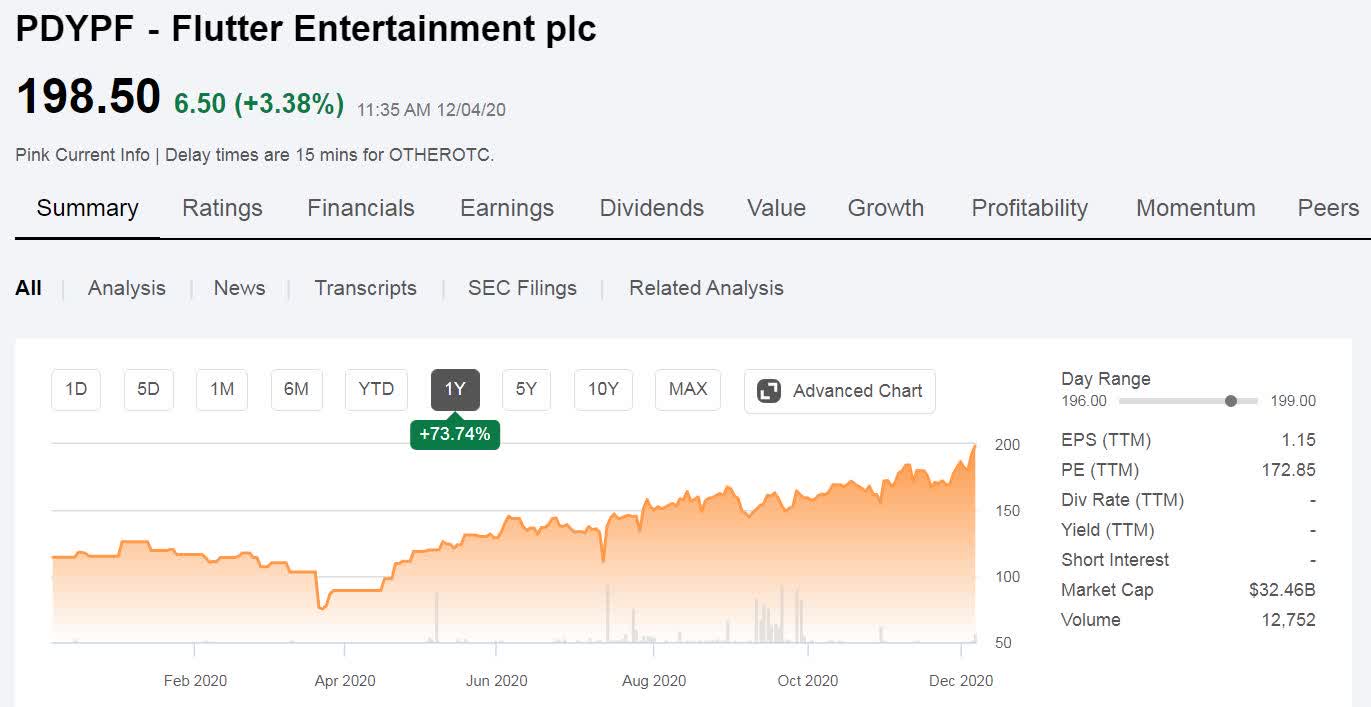

The sports betting sector eagerly awaits what Flutter Entertainment will do next.Flutter Chairman Rumor Could Confirm US Stock Listingįlutter Entertainment (OTC: PDYPY) is close to hiring a new chairman and that candidate’s background could signal the gaming company will forge ahead with plans to list its stock in the US. The uplisting of Flutter Entertainment could give more opportunities to invest in the parent of FanDuel, and could also lead to a spinoff of the sports betting company down the road. Revenue in the US region was $3.2 billion for the company. The company reported a 50% market share in the U.S. What’s Next: In 2022, FanDuel saw revenue increase 27% to $9.19 billion. investors and the broader market,” Mazza said. exchange, Flutter Entertainment’s dual listing might help to increase its exposure among U.S. While DraftKings may receive more attention due to its U.S.-based origin and trading on a U.S.

market, is an important aspect of Flutter’s portfolio. “Owning a majority stake in FanDuel, which has positioned itself as a leader in the U.S. exchange could also help the FanDuel parent company increase visibility and gain exposure to investors looking for a way to invest in the sports betting space outside pure-play DraftKings Inc (NASDAQ:DKNG). Investment Opportunity: Mazza said that given the success of online gaming in mature markets like the United Kingdom and Sweden, there is “still room for growth and expansion in the online gaming market worldwide.”Ī listing on a U.S. Related Link: Can Aaron Rodgers Help New York Jets Break The Longest Playoff Drought, A Look At The Betting Odds The growth is mainly driven by the ongoing transition from physical to digital platforms, fueled by positive regulatory momentum and increased market penetration,” Mazza added. “The company operates in the global online gaming market, which we believe has significant potential for future growth. Flutter Entertainment is the third-largest holding of the ETF at 6.4% with shares from the London Stock Exchange held in the fund. Roundhill Investments launched the Roundhill Sports Betting & iGaming ETF (NYSE:BETZ) in 2020 as the first pure-play ETF for the sector. investors with another way to gain exposure to one of the industry leaders in sports betting and iGaming outside of an OTC,” Roundhill Investments Chief Strategy Officer Dave Mazza told Benzinga. “Flutter Entertainment’s dual listing would allow the company to possibly 'uplist' to a U.S. Flutter Entertainment is also a partner with Fox Corporation (NASDAQ:FOX)(NASDAQ:FOXA) on FoxBet.Ī March report from Flutter Entertainment said the company’s FanDuel unit, which Fox also has a stake in, had 50% market share in the United States, which could make the company’s uplisting and a potential IPO of FanDuel catalysts for the stock. The company is the owner of popular brands like Betfair, Paddy Power, PokerStars, Sky Betting, Sportsbet and is the majority owner of FanDuel. listing, which could see shares listed on the New York Stock Exchange or NASDAQ.įlutter currently trades on the London Stock Exchange and as an OTC stock in the United States. What Happened: Flutter announced last week that the company received shareholder approval for a secondary U.S.

Here’s what the news from Flutter Entertainment (OTC:PDYPY) means for investors and the sports betting sector. listing, which could give investors more opportunities to own a stake in the market leader. A leading sports betting operator received shareholder approval for a secondary U.S.

0 kommentar(er)

0 kommentar(er)